When I first read the newest book of George Soros – The New Paradigm for Financial Markets – I did not realize how prophetic he was in terms of the collapse of the banking system. He published his book in May and I’ve read it in August. Few weeks later Lehman Brothers went under…

Here are some paragraphs illustrating his foresight:

“When the financial system is endangered, the authorities must cave in. Whether they like it or not, institutions engaged in the credit creation must accept the fact that they are being protected by the authorities. They must, therefore, pay a price for it.

The authorities must exercise more vigilance and control during the expansionary phase. That will undoubtedly limit the profitability of the business. The people engaged in the business will not like it and will lobby against it, but credit creation has to be a regulated business.

Regulators ought to be held accountable if they allow matters to get out of hand so that an institution has to be rescued. In recent years matters did get out of hand . The financial industry was allowed to get far too profitable and far too big.”

Sunday, November 23, 2008

Tuesday, November 11, 2008

It's a scam!

Much has been already said and written about the undercurrents of the financial crisis affecting the US and global economy. The closer one analyses it, the more it looks like a Ponzi scheme. I won't be able to describe it better than what I found on a recent blog:

http://aotearoaawiderperspective.wordpress.com/2008/11/13/the-two-trillion-dollar-black-hole/

How could such a strong economy fall into the trap of creating super bubbles, and then collapsing under its own weight? The answer is “lack of adequate regulations” in the financial system. Signs of self-implosion have been noted periodically in other sectors, but every time the answer was the expansion of trading zones (from national to regional, to continental, to global) in order to attract new people putting money into the pull, and thus keeping alive the illusion of perpetual outstanding returns.

The only difference now is that the inputting resources have reached their limits. The global population of potential contributors has been exhausted for the moment – until the purchasing power of the consumer markets like China, India, Russia and Brazil are brought up to par with the western counterparts.

Unfortunately, this crisis will not be the last one of this type. History will repeat itself years later, in a slightly different form, but fundamentally the same, because greed and irrational behaviour is embedded in the human nature.

http://aotearoaawiderperspective.wordpress.com/2008/11/13/the-two-trillion-dollar-black-hole/

How could such a strong economy fall into the trap of creating super bubbles, and then collapsing under its own weight? The answer is “lack of adequate regulations” in the financial system. Signs of self-implosion have been noted periodically in other sectors, but every time the answer was the expansion of trading zones (from national to regional, to continental, to global) in order to attract new people putting money into the pull, and thus keeping alive the illusion of perpetual outstanding returns.

The only difference now is that the inputting resources have reached their limits. The global population of potential contributors has been exhausted for the moment – until the purchasing power of the consumer markets like China, India, Russia and Brazil are brought up to par with the western counterparts.

Unfortunately, this crisis will not be the last one of this type. History will repeat itself years later, in a slightly different form, but fundamentally the same, because greed and irrational behaviour is embedded in the human nature.

Monday, October 20, 2008

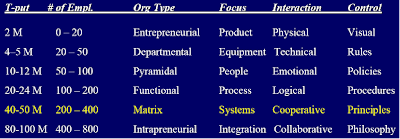

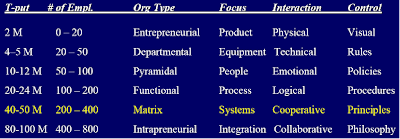

The Corporate Growing Process

I followed the evolution of various private companies, in their early stages, before they become big conglomerates. I noticed substantial similarities, and based on such observation I developed a map indicating the correlation between the main organizational parameters. After consulting with numerous people in different industries, and upon discussing it in a series of forums and functions, I gained enough confidence in its validity to submit it for public review.

My analysis was triggered by Peter Drucker’s assertion that “any organization that doubles or triples in size over a short period of time has necessarily outgrown its theory”. What I found was a series of examples of cyclical evolutions, each being characterized by certain essential attributes: Size (expressed in Throughput or number of employees), Organizational structure, Strategic focus, Mode of interaction and Control mechanisms - to name a few.

Another interesting finding was the realization by consulted experts in the field, that the chart offers not only an evolution map, but also provides answers to problems of dis-functionality and misalignment, as noticed in organizations situated on different stages of development.

My analysis was triggered by Peter Drucker’s assertion that “any organization that doubles or triples in size over a short period of time has necessarily outgrown its theory”. What I found was a series of examples of cyclical evolutions, each being characterized by certain essential attributes: Size (expressed in Throughput or number of employees), Organizational structure, Strategic focus, Mode of interaction and Control mechanisms - to name a few.

Another interesting finding was the realization by consulted experts in the field, that the chart offers not only an evolution map, but also provides answers to problems of dis-functionality and misalignment, as noticed in organizations situated on different stages of development.

Monday, October 13, 2008

Organizational Entropy

According to the second law of thermodynamics, during any process the change in entropy of a system and its surroundings is either zero or positive. In other words the entropy of a closed system tends toward a maximum. I was always wondering if this principle holds true in a business environment.

In its sociological application the concept of entropy is used as a metaphor for chaos, disorder or dissipation of energy. In a company - as a closed system - the energy is conserved. But it tends to degrade from useful forms to useless ones: everybody’s busy but value is not created.

The entropy of an organization is reflected in the amount of energy not converted into work during a process. The more uncertainty in vision, randomness in strategy, or indecision in action, the higher the entropy. Entropy is a measure of the inability of a system’s energy to do useful work; it becomes a measure of the business inefficiency.

In its sociological application the concept of entropy is used as a metaphor for chaos, disorder or dissipation of energy. In a company - as a closed system - the energy is conserved. But it tends to degrade from useful forms to useless ones: everybody’s busy but value is not created.

The entropy of an organization is reflected in the amount of energy not converted into work during a process. The more uncertainty in vision, randomness in strategy, or indecision in action, the higher the entropy. Entropy is a measure of the inability of a system’s energy to do useful work; it becomes a measure of the business inefficiency.

Thursday, September 25, 2008

The US Financial Crisis and Other Parallels

I only understand a fraction of the economic impact the experts predict as a result of the banking crisis in the US. And I know I am not the only one feeling this way – including some of the people that are expected to be the ones deciding how to get out of this mess.

What is really puzzling to me is how we all listen to and expect solutions from the same people who allowed this crisis to happen in the first place. How could they be trusted? They either don’t have the expertise or the integrity to be in charge with this recovery.

Unfortunately, this is not the only field where overdependence on few technical experts could be detrimental to an entire system. IT is another example where crisis of a magnitude threatening to paralyze an entire organization could occur. And most of the time we rely on the recommendations of the same people who were responsible to prevent it, and there is nothing we could do but to follow their advice to spend substantial amount of money upgrading or updating, because “the consequence of doing nothing is more costly than the alternative” – didn’t we just hear that from the financial experts of the day?

I guess this is the new way of justifying decisions of “strategic importance” – the war in Iraq (on terror) has been explained this way numerous times. In reality though is just a manipulative exploitation of the human psychology which is by nature risk seeking to gains and risk averse to losses.

What is really puzzling to me is how we all listen to and expect solutions from the same people who allowed this crisis to happen in the first place. How could they be trusted? They either don’t have the expertise or the integrity to be in charge with this recovery.

Unfortunately, this is not the only field where overdependence on few technical experts could be detrimental to an entire system. IT is another example where crisis of a magnitude threatening to paralyze an entire organization could occur. And most of the time we rely on the recommendations of the same people who were responsible to prevent it, and there is nothing we could do but to follow their advice to spend substantial amount of money upgrading or updating, because “the consequence of doing nothing is more costly than the alternative” – didn’t we just hear that from the financial experts of the day?

I guess this is the new way of justifying decisions of “strategic importance” – the war in Iraq (on terror) has been explained this way numerous times. In reality though is just a manipulative exploitation of the human psychology which is by nature risk seeking to gains and risk averse to losses.

Tuesday, September 9, 2008

Perceived Value of Small Compensation

I was wondering what is the level of compensation that would be perceived by someone as a fair reflection of contribution? After studying this for a while I concluded that 15% is the tipping point, above which people feel rewarded as opposed to just fairly compensated.

At 5% most people perceive the gesture as a correction and do not attach any rewarding value. Examples in this category include adjustments for inflation, convenience fees, acceptable margin of error etc.

10% is considered an entitlement by most people – expectation of discounts built into the price, reasonable profit margins, bonus for meeting expectations etc.

A compensation factor around 15% starts to receive a rewarding meaning: tips for waiters in a restaurant, eye catching discounts for “on sale” advertising. When it comes to a salary increase, unless it is at this level a person will interpret it as being either a simple correction (5%) or the result of a regular performance review (10%). Only at 15% the increase will be perceived as promotion related.

At 5% most people perceive the gesture as a correction and do not attach any rewarding value. Examples in this category include adjustments for inflation, convenience fees, acceptable margin of error etc.

10% is considered an entitlement by most people – expectation of discounts built into the price, reasonable profit margins, bonus for meeting expectations etc.

A compensation factor around 15% starts to receive a rewarding meaning: tips for waiters in a restaurant, eye catching discounts for “on sale” advertising. When it comes to a salary increase, unless it is at this level a person will interpret it as being either a simple correction (5%) or the result of a regular performance review (10%). Only at 15% the increase will be perceived as promotion related.

Tuesday, August 26, 2008

Extrapolating the Scrambled Words Experiment

“The phaonmneal pweor of the hmuan mnid - aoccdrnig to a rsecearh at Cmabrigde Uinervtisy - is taht it dseno't mtaetr in waht oerdr the ltteres in a wrod are, the olny iproamtnt tihng is taht the frsit and lsat ltteer be in the rghit pclae. The rset can be a taotl mses and you can sitll raed it and urnetdansd it. Tihs is bcuseae the huamn mnid deos not raed ervey lteter by istlef, but the wrod as a wlohe.”

If you can read and understand the above paragraph you just proved the point that our brain develops understanding of notions not based on details or sequence of events but based on the big picture. In understanding a written word what it counts is that the first and last letters are correct and that the number of letters – the length of the word - is accurate. The order in which the letters are written seems to have a much lesser importance than initially thought. The humans are capable of figuring out the rest.

The same seems to be true in relation to management practices. When leaders provide an objective assessment of the current stage (the frame of reference) a clear articulation of the final objective (vision or goal) and a strategic direction that links the two in a credible manner, the employees are able to carry on the action without the need for step by step instructions. Next time when you need to formulate a plan of action make sure that the initial and final stages are clear and the generic strategy is explained, and you may not need to spend too much time in documenting all the details. People will be able to fill up the gaps and connect the dots by themselves.

If you can read and understand the above paragraph you just proved the point that our brain develops understanding of notions not based on details or sequence of events but based on the big picture. In understanding a written word what it counts is that the first and last letters are correct and that the number of letters – the length of the word - is accurate. The order in which the letters are written seems to have a much lesser importance than initially thought. The humans are capable of figuring out the rest.

The same seems to be true in relation to management practices. When leaders provide an objective assessment of the current stage (the frame of reference) a clear articulation of the final objective (vision or goal) and a strategic direction that links the two in a credible manner, the employees are able to carry on the action without the need for step by step instructions. Next time when you need to formulate a plan of action make sure that the initial and final stages are clear and the generic strategy is explained, and you may not need to spend too much time in documenting all the details. People will be able to fill up the gaps and connect the dots by themselves.

Wednesday, August 20, 2008

A Business Environment Conundrum

Opportunities are created by a disturbance in the business environment (break-through technology, misalignment of capabilities and costs, disproportion of supply and demand etc.). Therefore, entrepreneurial initiatives tend to migrate toward in-balanced environments (Dubai’s no-tax territory, China’s cheap labour and artificially weak currency).

For a while, I thought that stable and predictable conditions should attract business; it is still true for companies enjoying monopolistic positions. However, stability and order in the business environment will eventually even-up the plain field, thus favouring perfect competition, a climate where the opportunity to make money is substantially diminished.

A community which intends to attract businesses must come-up with a disruption in its settings. The challenge for local governments is to abdicate their traditional role of creating and maintaining order and balance, and adjust to the less rational mission of enabling abnormalities.

For a while, I thought that stable and predictable conditions should attract business; it is still true for companies enjoying monopolistic positions. However, stability and order in the business environment will eventually even-up the plain field, thus favouring perfect competition, a climate where the opportunity to make money is substantially diminished.

A community which intends to attract businesses must come-up with a disruption in its settings. The challenge for local governments is to abdicate their traditional role of creating and maintaining order and balance, and adjust to the less rational mission of enabling abnormalities.

Thursday, August 14, 2008

Seven Samples of Behavioural Wisdom

· Nobody cares how much you know until they know how much you care.

· Think how to make the pie bigger before thinking how to get a bigger slice.

· Put ideas in writing; writing needs clarity which - in turn- requires understanding first.

· Strive for more if you want to do enough.

· You get the behaviour that you reward and the attitude that you accept.

· Smart people learn from somebody else’s mistakes; average people learn from their own; some people don’t learn – they are, simply, different!

· Do your job with passion and pride. That makes you a good player. Great players make the coach look great.

· Think how to make the pie bigger before thinking how to get a bigger slice.

· Put ideas in writing; writing needs clarity which - in turn- requires understanding first.

· Strive for more if you want to do enough.

· You get the behaviour that you reward and the attitude that you accept.

· Smart people learn from somebody else’s mistakes; average people learn from their own; some people don’t learn – they are, simply, different!

· Do your job with passion and pride. That makes you a good player. Great players make the coach look great.

Thursday, August 7, 2008

About Organizational Growth

Organizations are like organisms. They are born, they evolve and they die. The evolution could be achieved in terms of either size (i.e. vertical integration, horizontal expansion) or wisdom. While the vertical and horizontal dimensions may have practical limits, the depth of knowledge and the degree of sophistication associated with complexity are boundless and should perpetually increase. Slowing or stopping the organizational growing process is a predictor of the approaching end.

Tuesday, August 5, 2008

Introduction

I was fascinated early in my adult life with the goal of achieving superior results through creating systems, developing processes and organizing resources in ways that allow improved functionality and optimized organizational performance.

The idea that organizations – as pool of people and talent - could be nurtured into successful enterprises through inspired leadership and inspiring management became the backbone of my professional life; throughout my career, I tried to understand it better and apply it in constructive ways, by enabling willing participants to reach their best potential to the benefit of the individuals, community they belonged to, and society at large.

Subscribe to:

Posts (Atom)